Why the Best Payroll Services in Singapore Are a Game-Changer for Modern Services

Why the Best Payroll Services in Singapore Are a Game-Changer for Modern Services

Blog Article

Browsing the Complexities of Pay-roll Compliance: Exactly How Specialist Solutions Ensure Regulatory Adherence

Professional services specializing in payroll conformity offer a sign of support through this labyrinth of complexities, providing a shield versus potential offenses and fines. By turning over the ins and outs of payroll conformity to these experts, organizations can navigate the regulative terrain with confidence and accuracy, guarding their procedures and making sure financial stability.

Significance of Regulative Compliance

Making sure governing compliance is vital for specialist services companies to maintain functional integrity and minimize legal dangers. Following policies stated by controling bodies is not just a box-ticking workout; it is a fundamental facet of upholding the credibility and count on that customers position in these companies. Failure to adhere to governing demands can result in extreme effects, including monetary charges, reputational damage, and also legal activity. Specialist solutions organizations run in an intricate landscape where laws and laws are constantly evolving, making it important for them to remain abreast of any adjustments and guarantee their practices stay compliant.

Proficiency in Tax Obligation Rules

Efficiency in browsing complex tax regulations is crucial for expert solutions organizations to keep monetary conformity and support moral criteria. Provided the ever-evolving nature of tax legislations, remaining abreast of adjustments at the government, state, and regional levels is paramount. Expert companies need to have a deep understanding of tax codes, deductions, credit scores, and conformity requirements to make certain precise economic coverage and tax declaring. By leveraging their know-how in tax obligation regulations, these companies can help customers reduce tax obligation responsibilities while avoiding costly charges and audits.

Surveillance Labor Laws Updates

Staying educated about the most recent updates in labor laws is crucial for expert services companies to guarantee compliance and reduce threats. As labor legislations undergo constant adjustments at the federal, state, and local degrees, keeping up with these advancements is vital to stay clear of prospective charges or legal issues - Best payroll services in Singapore. Expert solutions firms need to develop durable mechanisms to keep an eye on labor regulations updates successfully

One method for organizations to remain notified is by signing up for e-newsletters or notifies from pertinent federal government agencies, market organizations, or lawful specialists concentrating on labor law. These sources can offer timely alerts about new policies, modifications, or court rulings that may impact pay-roll conformity.

In addition, expert solutions firms can take advantage of payroll software application solutions that supply automatic updates to ensure that their systems are lined up with the most up to date labor legislations. Regular training sessions for human resources and pay-roll personnel on recent legal adjustments can additionally enhance understanding and understanding within the company.

Minimizing Conformity Risks

In addition, remaining educated regarding regulatory modifications is critical for lessening conformity risks. Professional services firms have to continuously check updates to labor legislations, tax laws, and reporting requirements. This positive strategy makes sure that pay-roll processes stay compliant with the most recent legal standards.

Additionally, spending in employee training on conformity issues can enhance awareness and decrease errors. By educating personnel on appropriate laws, regulations, and ideal practices, companies can cultivate a society of compliance and minimize the likelihood of infractions.

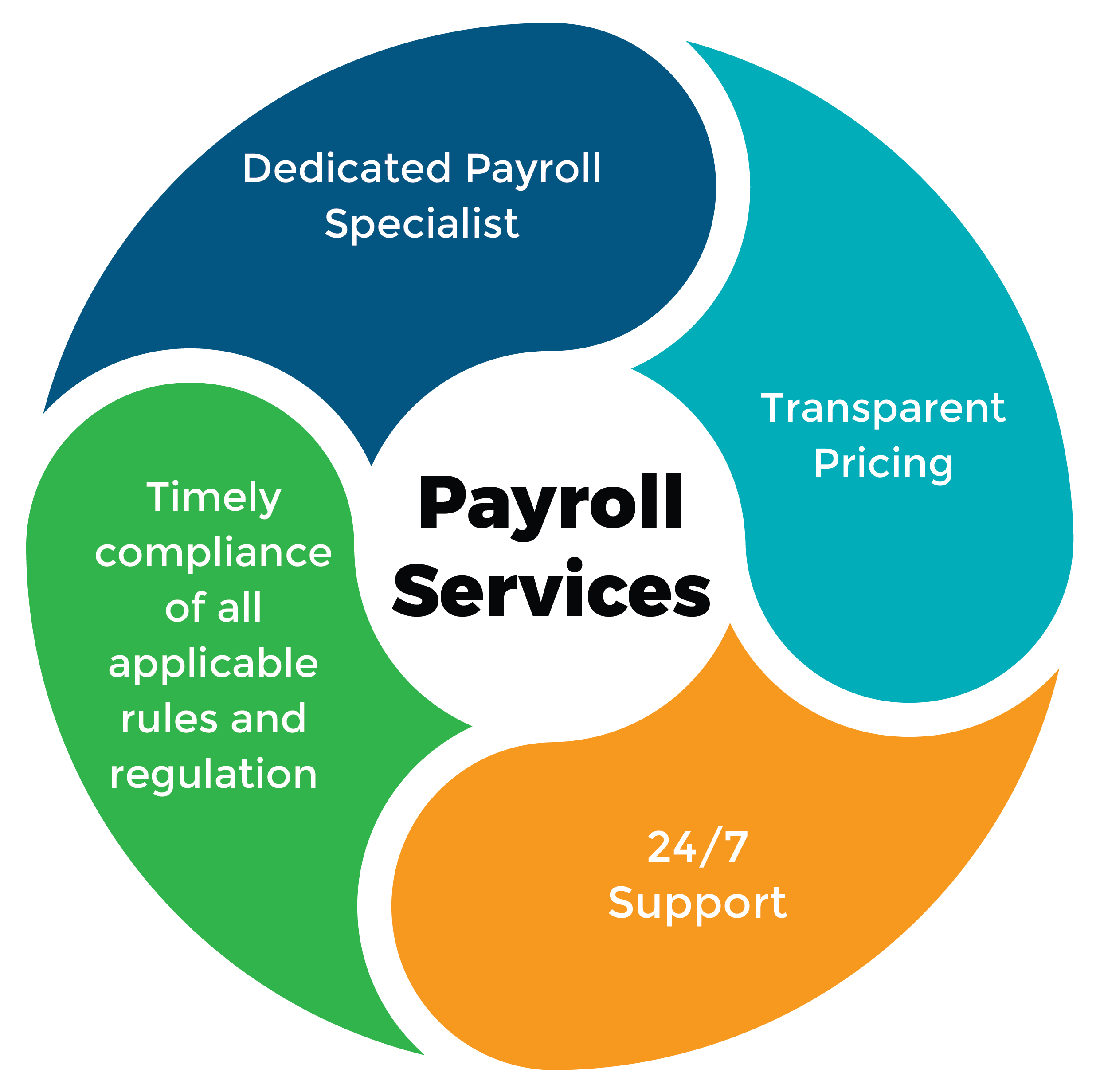

Benefits of Specialist Pay-roll Services

Navigating payroll conformity for expert solutions companies can be substantially streamlined through the use of specialist payroll solutions, providing a variety of advantages that enhance performance and precision in taking care of pay-roll processes. One essential advantage is proficiency (Best payroll services in Singapore). Professional payroll company are skilled in the details of payroll laws and can make sure compliance with ever-changing laws additional resources and tax obligation requirements. This read this post here know-how decreases the threat of errors and fines, conserving beneficial time and resources for the company.

One more benefit is the automation and combination capacities that professional pay-roll solutions provide. By automating regular jobs such as determining deductions, wages, and taxes, organizations can improve their pay-roll procedures and lessen the capacity for mistakes. Assimilation with other systems, such as accounting software program, further boosts performance by getting rid of the requirement for manual information entrance and reconciliations.

Additionally, specialist payroll solutions give safe data monitoring and privacy. They employ durable safety measures to safeguard delicate worker details, decreasing the risk of data violations and making sure conformity with information protection policies. Generally, the advantages of specialist pay-roll services contribute to set you back savings, precision, and tranquility of mind for expert services organizations.

Verdict

To conclude, professional pay-roll solutions play a critical role in guaranteeing regulative adherence and lessening conformity threats for services. With their competence in tax obligation regulations and consistent tracking of labor legislations updates, they supply beneficial assistance in browsing the intricacies of payroll conformity. By turning over payroll obligations to specialist solutions, services can concentrate on their core procedures while preserving lawful conformity in their payroll procedures.

To alleviate compliance risks properly in specialist solutions organizations, thorough audits of payroll procedures and documentation are important.Navigating pay-roll conformity for expert solutions organizations can be considerably structured via the application of professional pay-roll solutions, providing a range of advantages that improve performance and precision in handling pay-roll procedures. Expert payroll solution companies are well-versed in the intricacies of pay-roll guidelines and can ensure conformity with ever-changing laws and tax demands. In general, the benefits of specialist payroll solutions contribute to set you back savings, accuracy, and peace of mind for professional services companies.

By turning look at here now over pay-roll responsibilities to professional services, companies can focus on their core operations while preserving lawful compliance in their pay-roll processes.

Report this page